Top 7 Payment Gateways for Online Businesses in Australia

During the winter of 2019, Andrew came up with a great product idea, which would help reduce parcel theft; something which is rather prevalent in his area.

Months have gone by since then; in which time he has managed to build a prototype with the help of his sister. He reached out to a local auto parts shop that agreed to build it for his potential customers.

Next, he chose a fantastic theme on a CMS and had an online store ready to roll. But when it came to implementing a payment gateway on his site, he was lost.

First of all, there are so many to choose from! Each seemed as though it was the best payment gateway in Australia – exactly what he needed, but then there was the cacophony of financial terms like chargeback, payment processor, multi-step order processing and API he never knew he had to know about!

At this point, he had two choices.

One, hire a developer to get the gateway up and running on his site so that he can focus his time and energy on streamlining his business model.

Two, drop everything and figure out this tangled mess to find the best payment gateway in Australia for his business site.

He was at cross-roads as the first option would cost him money which he didn’t have much of.

The second option, however, would require time and energy which he wanted to put into his business development plan.

Andrew needed a document that would lay out the relevant features of the best payment gateways in layman’s terms, and provide basic instructions on how to implement them.

This is where we come in; if you are in a similar position, or you already have a business but want to switch to a different gateway, then please read on!

List of 7 best payment gateways in Australia

1. eWay

Website: https://www.eway.com.au/

Launch year

1998

Supported platforms

- Magento

- Shopify

- WooCommerce

- BigCommerce

- WP ecommerce

And 250+ shopping cart and software integrations.

Pricing info

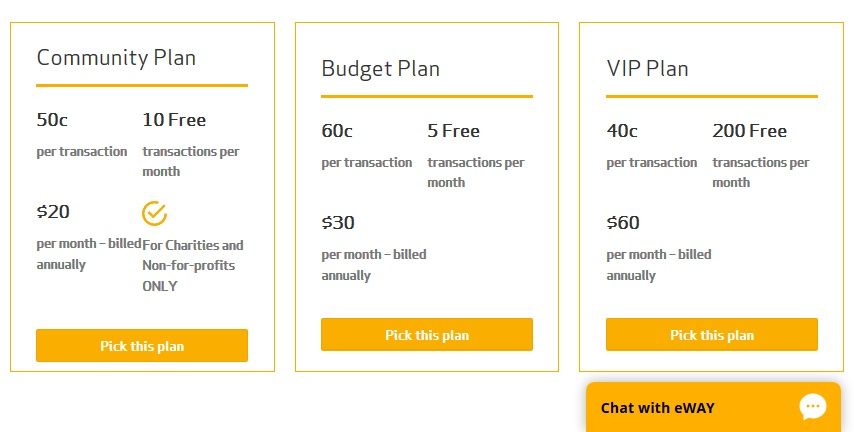

1.9% + 20c per Visa and MasterCard transaction for both domestic and international cards and eWay also offers 3 different plans to merchants using its gateway. Those are:

A merchant has the choice of either going for the flat “1.9% + 20c” or any of the plans shown above, as per Joel S, the sales executive from eWay.

If you already have an AMEX or Diners Club merchant account and want to integrate it with eWay, then eWay would charge you just the 20c. AMEX or Diners Club would charge you the 1.9%.

Payout method and frequency

Your sales or subscription revenue will be put directly into your bank account. This amount cannot be received in any digital wallet.

You should be aware that eWay will release your funds every 3 days, so do keep that in mind when you run ad campaigns.

Pros

- One of the most popular payment gateways in Australia

- Built-in fraud prevention tool

- Approved merchants don’t need a merchant account

- No set-up fees

- Transactions are risk-rated in real-time via the Beagle tool (a free plan)

- APIs are secure and robust, thus eWay can be integrated with almost any website on the planet.

- Good customer support

- Scalable payment solution

Cons

- Their built-in fraud prevention tool has to be manually activated from your merchant account.

- Only merchants with bank accounts based in Australia, New Zealand, Singapore, Hong Kong, Malaysia, and the UK can use eWay to receive payments.

Accepted modes of payment

- Cards accepted: Visa, MasterCard, American Express, Diners Club, JCB, Discover

- Digital wallets: Visa checkout, MasterPlus, Apple Pay

PCI compliance

Level 1 (the highest)

Method of integration into your website

eWay provides an integrated gateway known as iFrame solutions. You can access eWay API resources here.

Chargeback policy

For every chargeback payment, $44 will be incurred by you, the merchant.

Availability of a payment processor

Yes, eWay has its own payment processor.

Sign-up time

For sign-up, you have to provide government ID and bank account details. If these documents are available, then your account should be ready in 2-3 business days, but can sometimes take longer.

Rating

4.7/5.0 (based on 847 reviews)

2. SecurePay

Website: https://www.securepay.com.au/

Launch year

1999

Supported platforms

BigCommerce, Adobe Business Catalyst, Shopify, WooCommerce, ShopFactory. You can get the complete list of supported platforms here.

Pricing info

SecurePay offers you two payment receiving options. Those are:

- SecurePay Online Payments

- Combines a merchant account and a payment gateway

Domestic transactions:

1.75% + $0.30 per txn (fees inclusive of GST)

International transactions:

2.90% + $0.30 per txn (fees inclusive of GST)

No set-up fees

No monthly or annual fees

Transaction fees are applied to all transactions including refunds, pre-authorisation and Card-issuer declined payments.

Gateway solution

This plan is for those merchants who already have a merchant account with a bank or financial institution and want to work directly with it.

This plan has 3 options for you to choose from:

1. For those starting out

45c per transactions

$395 annual fee

2. For those who want to process a fixed number of transactions annually

Zero annual fees

$800 for 3,000 transactions (you can process no more than 3,000 transactions using this plan) If you use up all 3,000 transactions, it is automatically topped up.

3. For that processing over 5,000 transactions every month

You are eligible to contact SecurePay and negotiate custom pricing.

For those making over $1M in revenue

There is:

- Tailored pricing

- Dedicated support

- Account management

You can contact SecurePay for details if you fit these criteria.

Recurring Billing

- $1 per debit

- $75 monthly fee

- No annual or set-up fees

Payout method and frequency

Dependent on SecurePay risk assessment policies.

Pros

- Detailed reporting provided

- Australian bank support

- Provides virtual terminal

- Offers free trial

- Advanced fraud protection

- Offers batch processing of payments

- Provides sandboxing to test the gateway

- Customisable payment page

Cons

- Hidden fees (PCI certification fee, service termination fee etc.)

- It’s difficult to print reports

- Does not provide PoS

Accepted payment methods

All major cards, as well as PayPal

PCI compliance

Level 1

Method of integration in your website

You can access the link to the SecurePay API page here.

Availability of a payment processor

Yes, it has its own payment processor and thus does not need to integrate with a third-party processor.

Chargeback

In the case of a chargeback, SecurePay will charge you a fee of $25.

Rating

4.2/5.0

3. Square

Website: https://squareup.com/au/en

Launch year

2009

Supported platforms

Shopify (through a 3rd party app)

Vend

WooCommerce

Xero

GoDaddy website+marketing

Acuity Scheduling

Pricing

The app–free

The square reader– $59 or 3 payments of $20

For every transaction—1.9% per tap or dip for Visa, MasterCard, American Express, eftpos and international credit cards

Pros

- Virtual terminal available

- Card can be stored on file

- It comes with competent reporting tools

- It offers end-to-end encryption for transactions

- Unlike many other gateways, it offers next-business-day deposits

- It doesn’t charge any fees for refund

- As part of its chargeback protection plan, it offers $250 every month

- For a small fee (1% of the transfer value), Square offers instant deposit

- Special iPad app for brick-and-mortar stores

Cons

- Transaction through card-not-present transactions are usually heavily scrutinized which leads to significant fee deduction.

- Disputes tend to go against the merchant in most of the cases.

PCI compliance level

Level 1

Method of integration

They provide all APIs and SDKs on their website along with documentation.

4. WorldPay

Website: https://www.fisglobal.com/en-au/merchant-solutions-worldpay

Launch year

1997

Supported platforms

- Shopify

- BigCommerce (hosted)

- WooCommerce

- Magento

- WP Commerce

Pricing

WorldPay offers two pricing plans:

- Pay as you go (2.75% + A$0.37 for both credit and debit cards)

- Pay monthly (A$37.35 plus 2.75% for credit cards and 0.75% for debit cards)

If you are processing over 1,000 transactions every month, you can contact WorldPay for discounts on volume pricing or pay monthly options.

Payout method and frequency

Twice a week into your bank account.

Pros

- They will help you get a PCI DSS compliance certificate (for just A $56.15 per year)

- WorldPay is available in over 146 countries

- It supports over 126 currencies

- Doesn’t charge you extra fees for subscription and billing

- Has built-in fraud prevention tools for safer transactions

- Their live dashboard lets you watch the order in real-time.

- No additional fee to process refunds (does not include bank fees)

- Virtual terminal available

- Provides credit card machines

- Supports PayPal integration

Cons

- Perhaps too many services! You have to do your own research before you look at their services.

- Doesn’t offer a FREE trial

Accepted cards

All major cards are accepted

Method of integration

A list of APIs for WorldPay can be found here.

Chargeback

In case of a chargeback, WorldPay will charge you $29 AUD. This will be returned to you if the customer revokes the chargeback request.

Availability of payment processor

Yes, WorldPay comes with its own payment processor

Rating

4.4/5.0 (average value)

Over 90% of its users would recommend it to a friend or colleague.

Prohibited items

The following are items you cannot sell via WorldPay gateway:

- Casinos’ and gambling equipment

- Race betting

- Pornography

- Replica merchandise

- Tobacco and cigars

- Firearms

- Medicines

The complete list can be found here.

5. Pin Payments

Website: https://pinpayments.com/

Launch year

2011

Supported platforms

Shopify, WooCommerce, BigCommerce, Chargify, Magento, ChargeBill, Snipcart. You can find the complete list of platforms that support Pin Payments here.

Pricing

With Pin Payments, you will be charged at different rates for domestic and international transactions.

Domestic transactions

1.75% + 30c

International transactions

2.9% + 30c

If you are accepting payments in a foreign (relative to Australia) currency, you would be charged a 1.7% conversion fee. If you want to receive your revenue in foreign currency without conversion, you would be charged 3.6% + 30c.

If you transfer funds from your Pin Payments account to a third party bank account via APIs, you would be charged a 30c fee.

If you are processing a high volume of transactions, you can contact them to negotiate a reduced per-transaction fee.

Payout method and frequency

Your business revenue is paid out to your bank account in 3 business days.

Pros

- Recurring billing services provided

- Reduced rate for non-profit organisations.

- Fraud protection tools

- No merchant account required

- No lock-in contract

- Customer card can be pre-authorized without charging

- Seamless performance across devices

- APIs are super easy to integrate

- Decent customer support

- Customer card can be verified before processing order

Cons

- Do not provide mPoS

- In the case of foreign currencies, the payout may take up to 7 business days.

- Merchants have to share receipts with customers via screenshots.

Accepted cards

Any card bearing the log of VISA, MasterCard or AmericanExpress is supported by Pin Payments.

PCI DSS compliance

Level 1

Method of integration in your website

You can access the Pin Payments integration guide here.

Chargebacks

If the cardholder is awarded in a dispute situation, you will be charged an administration fee of $25.

Availability of payment processor

Yes, it has its own payment processor.

Sign-up

Your government ID will be required. The sign-up process takes 10 minutes overall. Typically, merchant accounts are approved and ready to use within a single business day.

Rating

4.3/5.0

Prohibited items

None found.

6. ANZ eGate

Website: https://anzworldline.com.au/en/home.html

Launch year

2001

Supported platforms

- Custom ecommerce

- Magento 2

- WooCommerce

- Opencart

- PrestaShop

Pricing info

ANZ and Worldline offer best-in-class payment solutions. New customers get an offer to save over hundreds of dollars with free terminal rental fees for 12 months, including a $0.20 debit charge fee and a $1.1% merchant service fee.

As the pricing may vary depending on the specific plan you choose and the volume of transactions you process, it will be worth contacting ANZ directly to discuss your particular needs and to obtain a quote for ANZ eGate.

Payout method and frequency

Businesses can securely accept and process customer payments by credit or charge via a website or call centre. Payments requested on a bank business day before 6 PM (AEST) will be processed to the account on the same day. And payment that will be requested after that particular time will be debited immediately but may be processed on the following bank business day.

Pros

- A division of the renowned ANZ bank group.

- Easy set-up process.

- Offers same-day fund settlement.

- Allow customers to pay from anywhere.

- Top-notch security feature.

- Uses industry-standard encryption.

- Easy integration.

- Scalable payment solution.

Cons

- Too expensive.

- ANZ may not be compatible with all business types.

- Include some challenges with customer service.

Accepted modes of payment

Visa, MasterCard, American Express, JCB and Diners Club International.

PCI compliance

Level 1

Availability of a payment processor

Yes, ANZ eGate has its own payment processor.

Method of integration in your website

You can check out the merchant virtual integration guide here.

Rating

4.3/5.0

7. 2checkOut

Website: https://www.2checkout.com/

Launch year

1999

Supported platforms

Supported on 100 ecommerce, shopping cart and invoicing system platforms including Shopify, BigCommerce, WooCommerce, Magento and Drupal Commerce.

Pricing info

- 3.5% + A $0.51 per successful sale (if you sell physical products online)

- 4.5% + A $0.66 per successful sale (for recurring billing)

- 6.0% + A $0.88 per successful sale (for digital products such as eBooks, music, etc.)

Payout method and frequency

2CO pays your revenue to you via wire, ACH, Payoneer, check and Webmoney. Payout frequency means how often 2checkout releases your collected revenue. 2checkout releases funds on a weekly basis. When receiving your money from 2checkout, there is a minimum transfer limit.

Minimum transfer limit

- $50/€50/£50 (2 Sell and 2 Subscribe)

- $100/€100/£ 100 (2 Monetize)

Merchants have the option to negotiate with 2checkout regarding payout frequency, however, and they do reduce the frequency in some cases.

If your request for a shorter payout frequency is approved, make sure you have it in writing.

Pros

- 87 currencies, 15 language support

- Flat-rate fees for every country under the sun

- Advanced fraud protection

- Both hosted and inline checkout options available (hosted checkout takes your customer to the payment gateway website. Inline keeps them on your website)

- Mobile responsive

- Offers recurring billing

- WordPress carts can be integrated

- Supports countries where the laws are unfriendly for SME owners

- Customers can blacklist fraudulent sellers.

- Provides tools to reduce cart abandonment

- Helps drive traffic to your website

- Customizable checkout page

Cons

- Merchant account required

- No digital wallet available (you can’t store money to purchase anything as you can with PayPal)

- Live Chat is not available for merchants.

Accepted cards

Visa (debit card & credit card)

MasterCard (debit card & credit card)

American Express (credit card only)

A complete list of payment methods supported by 2CO can be found here.

PCI compliance

Level 1 certified (the highest)

Method of integration in your website

You can access the API resource page of 2checkout here.

Chargeback

Chargebacks are the sort of refund that your customer demands from his/her bank or other concerned financial institution instead of you directly.

When it comes to 2checkout, chargebacks for payments issued via the following credit/debit cards are valid:

- VISA/MasterCard

- American Express

- Discover

- JCB

- Carte Bleu

- Diners Club

- EloCard

- HiperCard

- UnionPay

Availability of a payment processor

It comes with its own payment processor.

Sign-up time

It takes about 5-10 minutes to sign up, provided you have all the documents. In case you don’t, you can save and continue later from where you left. During sign-up, you need to upload the following documents:

- Government-issued ID

- Valid proof of address

- Business policies (refund, shipping, returning product)

Rating

- 4.5/5.0 by Joe Warnimont

- 4.5/5.0 by Rose Holman from Merchant Maverick

List of prohibited products

2checkout will not allow you to sell certain items via their payment gateway. The list of prohibited items can be found here.

If you have made it all the way to this point, then you most likely have a question burning in your mind. How can you avoid chargebacks?

To be honest, chargebacks are sometimes unavoidable, but you can significantly lower their frequency if you follow certain steps.

These steps are:

- State on your website or policy page the description that customers will see on their card statements.

- Charge customers only for the products that you display on your website. if you act as a third party, you are the one who has to deal with chargebacks.

- Implement card verification on your site.

- When required to refund, make sure you do so to the card that was used to make the payment.

- Address all disputes in the proper manner within a designated timeline.

- Take additional steps in the case of large payments to ensure that the payer is actually the cardholder.

- In the case of recurring billing, always inform the subscriber 4-5 days in advance.

- In the policies which are available on your site, put key points in a bold and bulleted format. Use icons to differentiate one segment from another. For example, use a money icon to differentiate the refund policy from the shipping policy.

The more you google for the best payment gateway in Australia, the more you’re prone to analysis paralysis. As a business owner, it’s imperative that you stay informed of every aspect of your business; payment gateways are crucial, and we recommend you remain on the lookout.

So which of the 7 gateways mentioned above do you think is the most suitable for your business?

You read a lot. We like that

Want to take your online business to the next level? Get the tips and insights that matter.