Ecommerce Payment Processing: A Complete Guide for Businesses

The ecommerce market is thriving at a rapid speed. In 2024, retail ecommerce sales are estimated to exceed 4.1 trillion U.S. dollars worldwide, and this figure is expected to reach new heights in the coming years. With so many customers doing their shopping online, ecommerce payment systems have become one of the top priorities for a digital storefront.

Imagine a clothing boutique that is going for 50% sale. However, as thousands of eager shoppers flock to the site, reach checkout, and find that the payment system is slow, outdated, and doesn’t support mobile payments, it will lead to hundreds of abandoned carts.

All this leads to the necessity of choosing a secure ecommerce payment processing solution. In this guide, we will share what ecommerce payment processing is, how it works and tips on how to find the right one for your online store.

What Is Ecommerce Payment Processing?

An ecommerce payment is a financial transaction that happens between a buyer and a seller in an online purchase. It is ecommerce payment processing that allows businesses to accept and process electronic payments when a purchase is made on an ecommerce site.

Here’s how it basically works:

- Customers select their product, proceed to checkout and enter their payment details.

- A payment gateway securely captures and encrypts the payment data and sends it to the payment processor.

- The payment processor communicates with the customer’s bank or card network and confirms the availability of funds as well as the validity of the payment method.

- Once everything works, the funds are transferred to the merchant’s account.

How Is It Different from Traditional Payment Processing?

When ecommerce payment processing takes place entirely online via websites or mobile apps, traditional payment processing mostly involves face-to-face interaction between the customer and the merchant. If we talk about the payment method, in traditional payment processing, the merchant is required to have a physical card terminal in order to take payments.

For ecommerce payment processing, the merchant needs an online checkout and a payment processor. Also, it involves additional security layers such as encryption, SSL certificates, and PCI compliance, while in traditional systems, it has built-in security with chip cards and PIN systems.

In short, ecommerce payment processing works for online transactions with advanced digital infrastructure, while traditional payment processing is fully focused on face-to-face sales in physical settings.

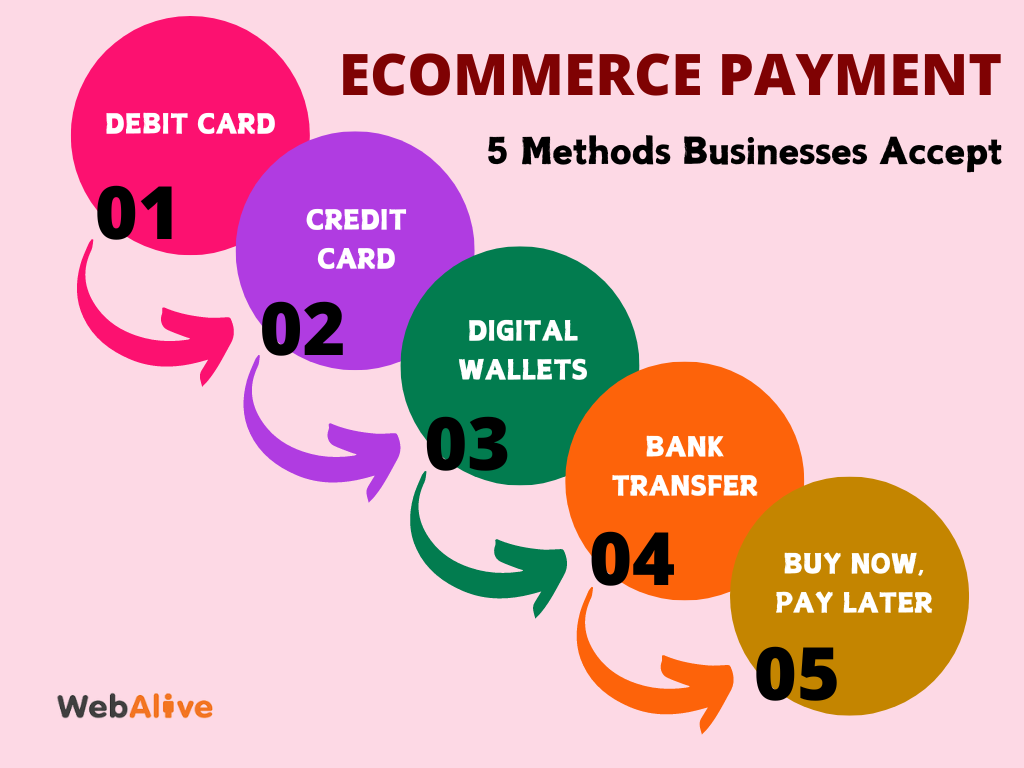

Types of Ecommerce Payment Methods Businesses Accept

1. Debit card

The debit card is one of the popular payment methods that allow customers to make their payments directly from their bank accounts. Here, when the payment is authorised, the funds are deducted immediately from the account.

2. Credit card

Credit cards are one of the most common types of ecommerce payment methods as they allow customers to make purchases using borrowed credit from the card issuer and let them pay off the balance in a given period. Major credit card brands like Mastercard, Visa, and American Express are some of the most widely accepted around the world.

3. Digital wallets

Digital wallets such as PayPal, Apple Pay, Google Pay, and Amazon Pay store customers’ payment information and allow for quick, secure and one-click purchases. It doesn’t require customers to enter their card details every time. These wallets are mostly linked to bank accounts and credit or debit cards and are already surpassing cards in popularity.

4. Bank transfer

Bank transfers, known as electronic funds transfers (EFT), allow customers to pay directly from their bank account to the business’s account. This method is convenient for larger transactions.

5. Buy now, pay later

It has become another popular ecommerce payment method in recent years that allows customers to purchase products immediately either by splitting the cost into interest-free instalments or by delaying the full payment until a later date.

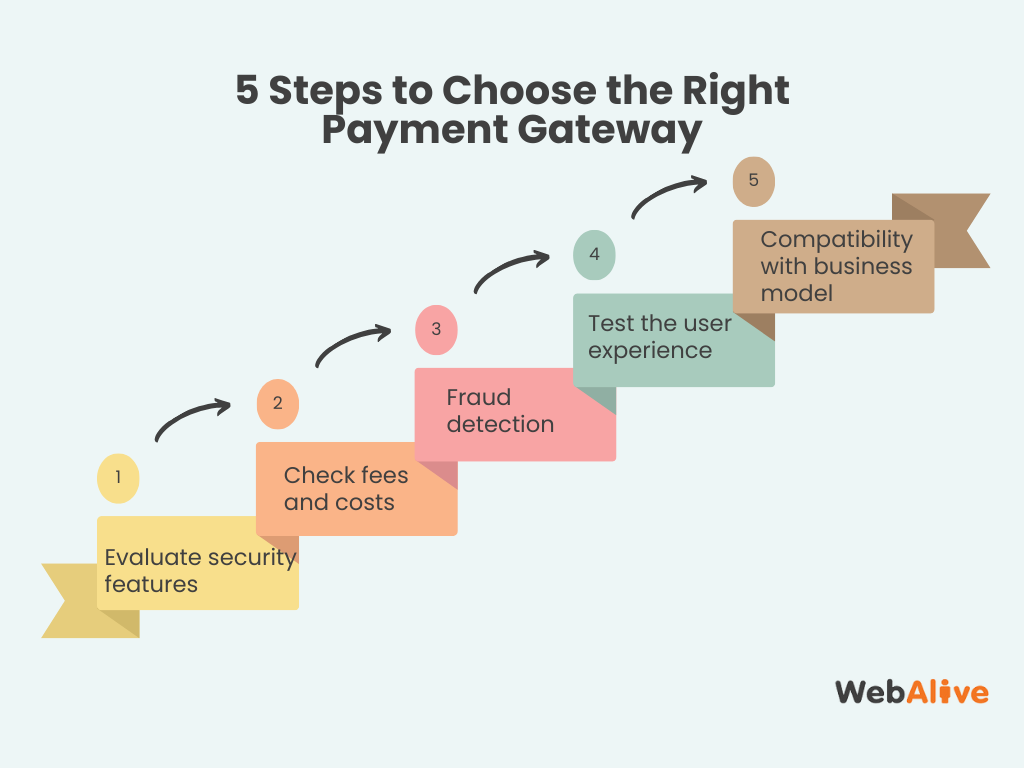

Steps to Choose the Right Ecommerce Payment Gateway

Picking the right payment gateway is an important business decision as it place an impact on the operational efficiency of your transactions as well as the customer experience that you offer.

1. Evaluate security features

Security is a primary concern. You must have to consider the key security features when choosing an ecommerce payment gateway. Look for a payment gateway that provides end-to-end encryption, meaning data is protected both during the transaction and at rest. Verify that the payment gateway uses SSL (Secure Socket Layer) or TSL (Transport Layer Security) encryption, as it ensures data protection during transmission.

This will minimise the risk of fraud by preventing hackers from intercepting and understanding sensitive payment information. Confirm that the payment gateway uses tokenisation as it reduces the risk of sensitive data being exposed even if your system is breached. Also, make sure the payment gateway supports two-factor authentication.

2. Check fees and costs

Check fees and costs as they directly impact your business’s bottom line. Mostly, gateways charge a transaction fee for every transaction processed, and this is unavoidable. But it may vary between providers. Also, some gateways charge a monthly subscription fee to offer premium services and advanced features.

So, consider this as well. If you have a smaller or newer business with fewer transactions, go for the no-monthly fee option. In addition, if you sell internationally, consider cross-border transaction fees as well to choose the right gateway with competitive international rates.

3. Fraud detection

It is a must-check factor to consider when selecting an ecommerce payment gateway, as protecting a business from financial losses, customer disputes, and chargebacks is the primary concern for any business. So, look for fraud detection features such as real-time fraud monitoring, machine learning and AI, card verification value or 3D secure authentication to select the right payment gateway.

For example, AI-powered fraud detection can spot any sort of fraud attempt while identifying the patterns of fraudulent behaviour. Also, if your gateway offers a 3D secure feature, it will ensure the person completing the transaction is a legitimate cardholder.

4. Test the user experience

Go through the entire checkout process as a customer to test the user experience. Check everything from adding items to cart to inputting payment details to completing the transaction. Test transactions across multiple devices as well including desktops, tablets and smartphones. Consider the speed and efficiency and find out how long it takes to complete the transaction.

Check the number of steps it requires to complete the checkout process as today’s customer prefer checkouts with fewer clicks. Test for guest checkout option and make sure that the process is simple and quick. Also, evaluate the checkout design as it is a branded and professional looking checkout page that builds trust and offers a consistent user experience.

5. Ensure compatibility with your business model

Go for a payment gateway that aligns with your business model. If your business provides subscription services you need a gateway that supports automated recurring billing alongside other flexible options for managing renewals and cancellations.

But if your payment gateway doesn’t support the payment methods your customers prefer or doesn’t provide recurring billing for subscriptions or doesn’t provide the option to offer payment in the local currency, it will make customer dissatisfied.

The importance of ecommerce payment processing for businesses

At the core of ecommerce is payment processing, which enables businesses to accept payments from customers through various methods. There are many key advantages to using an ecommerce payment processor. It allows the customer to finish their purchases quickly and securely. This will boost your revenue while building trust with your customers.

Without it, any business would struggle to convert website traffic into revenue. It has a direct impact on conversion rate as a secure checkout pushes the customer to complete their purchases. Eventually, ecommerce payment processing makes it possible for businesses to operate on a global scale.

Final words

In the end, we can come to the conclusion that it is wiser to thoroughly consider your options when you select a payment gateway. But first, you must be clear about what your business’s online payment needs. Then find the one that supports all your needs while driving customer conversion and retention.

You read a lot. We like that

Want to take your online business to the next level? Get the tips and insights that matter.